Protect your SAAS

from fake users with our smart KYC

Automatically detect and prevent fraud with our AI-powered identity verification widget.

Stop fake accounts and protect your revenue with intelligent triggers.

No credit card required.

Customers register to your platform

Our widget will automatically check..

AI-powered fraud detection

Our advanced AI algorithm automatically detects fraudulent behavior and triggers KYC verification when suspicious activity is detected

Fingerprint & IP tracking

Detect duplicate registrations and VPN/proxy usage with unique fingerprint IDs and IP address monitoring

Custom trigger rules

Set up automated KYC triggers based on country, email patterns, temporary mailboxes, and custom business rules

Bot & automation detection

Identify and block automated bots and suspicious user behavior patterns to prevent fraud and abuse

User is a real user, no action needed

User is suspicious, KYC is requested

User is now verified

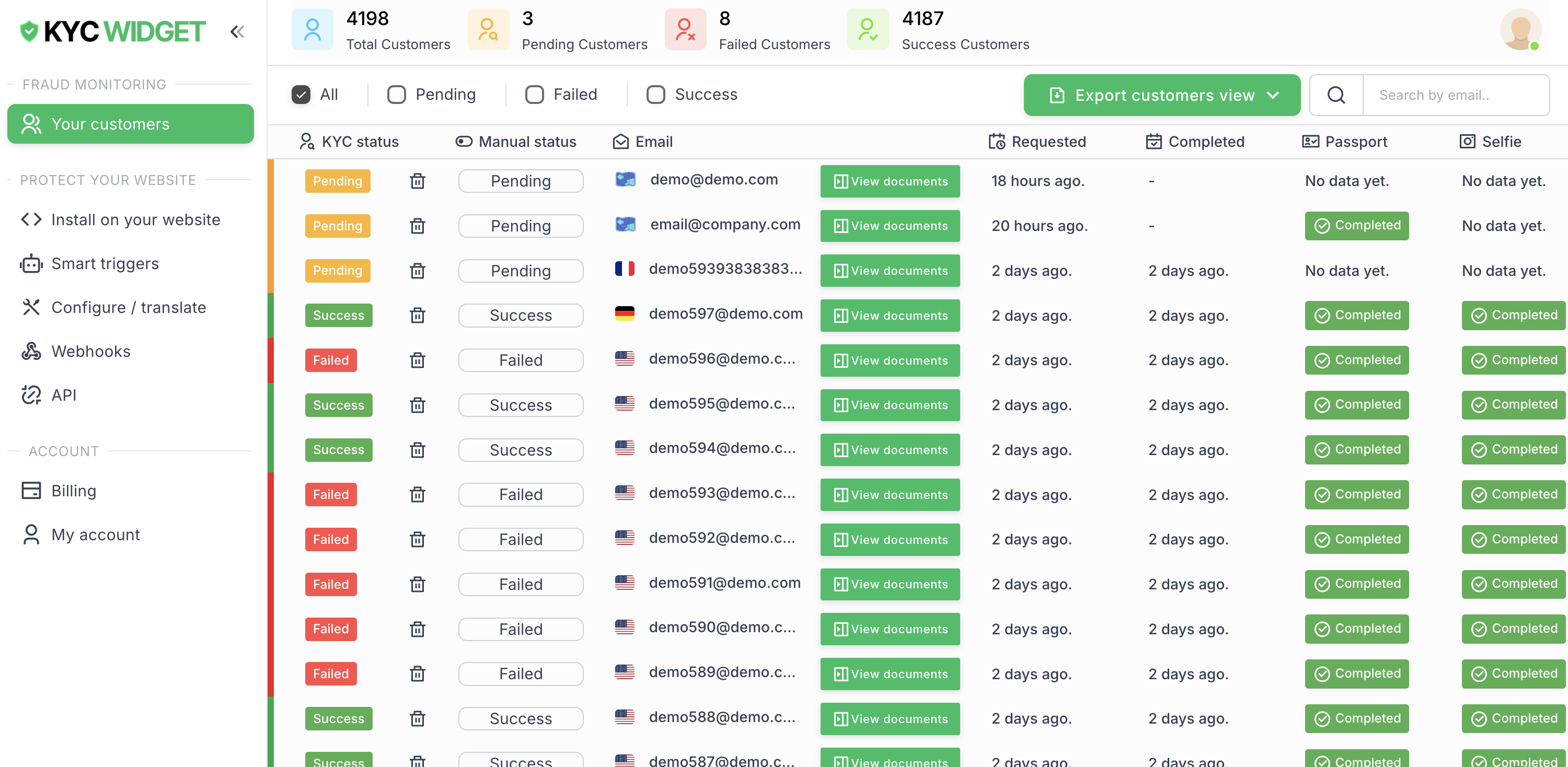

Customer Management

Manage your customers

Customer Dashboard

View all registered customers, track their KYC progress, and manage verification status in real-time.

Webhook Integration

Receive instant notifications when customers complete or fail identity verification.

API Access

Retrieve customer data programmatically and integrate verification results into your systems.

Verification Reports

Detailed reports on verification attempts, success rates, and fraud detection analytics.

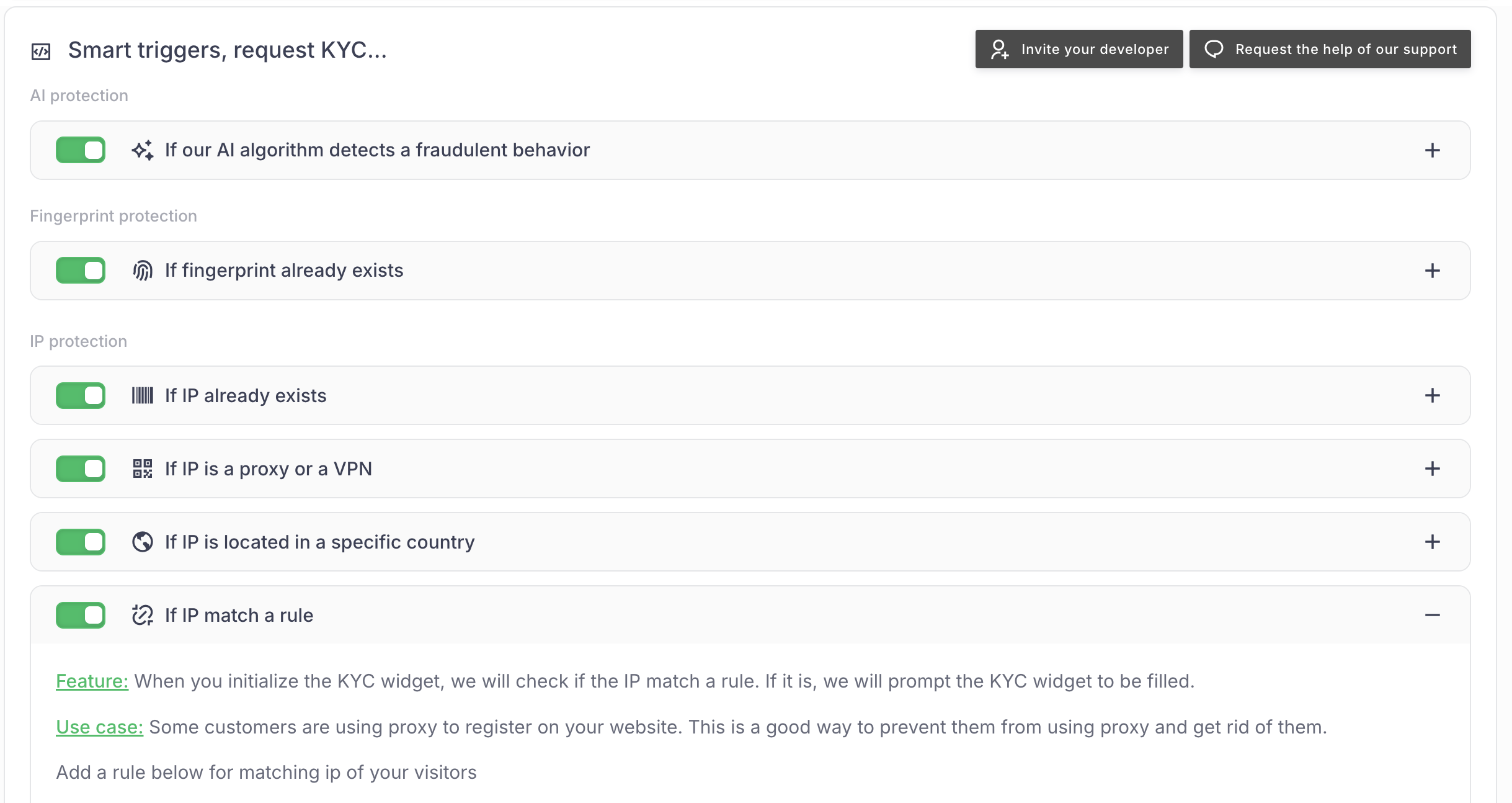

Advanced Triggers

Smart automation that protects your platform from fraud.

Fingerprint Detection

Automatically detect duplicate registrations using unique visitor fingerprints.

IP & Location Rules

Trigger KYC based on IP location, proxy/VPN detection, and country restrictions.

Bot Detection

Identify automated behavior patterns and suspicious user interactions.

Email Validation

Detect temporary mailboxes and suspicious email patterns automatically.

Advanced fraud detection and automated triggers

Our AI-powered system automatically detects suspicious behavior and triggers KYC verification when needed, protecting your platform from fraud while maintaining a seamless user experience.

95%

fraud detection accuracy

85%

reduction in fake accounts

60 seconds

average verification time

"The KYC widget has been a game-changer for our platform. Automated fraud detection has reduced our fake account creation by 85% while maintaining a smooth user experience. The AI triggers are incredibly accurate and save us hours of manual review every day."

AI-powered fraud detection

Our advanced AI algorithm automatically detects suspicious behavior patterns and triggers KYC verification to prevent fraudulent activities on your platform.

Smart fingerprint tracking

Automatically detect duplicate registrations and prevent fake accounts by tracking unique visitor fingerprints across your platform.

Geographic risk assessment

Set up automatic KYC triggers based on specific countries or regions to manage risk according to your business requirements.

Proxy and VPN detection

Identify users hiding behind proxies or VPNs and automatically trigger KYC verification to ensure legitimate user registration.

Ready to protect your website?

Install our widget on your website in minutes

Get Started