- 02nd Jul '25

- KYC Widget

- 19 minutes read

How eCheck Payments Work and Why Firms Should Use Them

So, what’s the deal with eChecks? They're like the hipper younger cousin of traditional checks. I remember the first time I encountered one—a friend tried to pay for lunch using their phone. I laughed, thinking, 'How fancy!' But really, eChecks are just electronic versions of regular checks, minus the drama of hunting for a pen or a stamp. They're great for law firms as they offer a quick, secure, and cost-effective way to collect payments. And honestly, who wouldn’t want that? No more late nights chasing debts or dealing with bounced checks. Let’s unpack this nifty payment method. You might just find it’s the next best thing since sliced bread—or maybe that’s just wishful thinking.Key Takeaways

- eChecks are electronic versions of traditional checks, making transactions quicker and easier.

- Law firms can save money and time by accepting eChecks, reducing processing fees.

- Security isn’t a myth—eChecks come with encryption that keeps sensitive data safe.

- Implementing eChecks can improve cash flow and streamline billing processes.

- Using eChecks is straightforward, meaning less time fussing with checks and more time practicing law.

Next, we’re going to dig into something that might sound overly technical but is more straightforward than it first appears: eChecks. Buckle up, because it’s quite a ride!

What Exactly Is an eCheck?

An eCheck is like a paper check that decided to go digital. Instead of hunting down a pen and a piece of paper, we simply type some info online. These checks allow businesses to snugly withdraw funds from a person's checking account with just a few key details:- Checking account number

- Bank routing number

- Payment amount

- Online check

- Internet check

- Direct debit

eChecks vs. Wire Transfers

While eChecks and wire transfers both do the nifty job of moving money, they operate like turtles and rabbits in a race. Wire transfers zip money from one bank to another, often for hefty transactions or even international trade. And let me tell you, those fees can be scarier than a horror movie! EChecks, however, waddle through in batches thanks to the ACH system (that’s the Automated Clearing House, if you're scratching your head). Plus, unlike a wire transfer that is set in stone once initiated, eChecks can sometimes be canceled. So, if you accidentally paid for your buddy's third round of drinks at the bar—yikes!—there's a glimmer of hope! But let's face it, wire transfers do have that comforting security blanket effect, even if it comes at a cost in both speed and expenses. Here’s what you might consider with wire transfers:- Fast but costly

- Non-reversible

- Involves direct bank interaction

eChecks vs. ACH Payments

Now, let’s chat about how eChecks fit into the wider payment puzzle. They’re processed via the ACH network, which helps streamline all those electronic payments. Polka dots couldn't look as good as a fancy ACH logo does on a chart! ACH payments are great for pretty much anything that doesn’t involve swiping a credit card or handwriting a check. This network has been around since the 1960s, creating smoother sailing for all sorts of online transactions. But here’s the kicker: not all ACH transfers are eChecks, but every eCheck is linked to ACH. So think of ACH like the big umbrella of electronic payments, where eChecks are just one very cozy section. If you're wondering about ACH payments, here's the lowdown:- Great for various direct payments

- Widely accepted in many fields

- Simple and efficient

Now we are going to talk about the ins and outs of eChecks. Grab a coffee, sit back, and let’s unravel how these electronic wonders work!

Understanding eCheck Payments

When it comes to accepting eCheck payments, it’s pretty much like running late to a dinner party—everything’s a bit rushed, but you still get there in one piece. While sending a traditional paper check could leave a person with nail-biting suspense, eChecks speed up the process and give everyone a sigh of relief. Imagine each time you receive an eCheck, it’s like someone handing you cash after a well-debated bet—no waiting for the bank to cash it! Plus, let’s be real: no paper checks means less chance for your nosy neighbor to snoop around. Processing times can throw us a curveball. They often hinge on: - Whether your payment provider has their act together - The time of day the transaction is sent—early bird gets the worm, right? - Whether you’re setting things up with an old or a brand-new business account. Usually, eChecks take about three to five days to process, but we’re living in a world of instant gratification, so sometimes you'll see funds appear in as little as 24 to 48 hours—just like magic! Now, let’s break down the steps that bring this process to life: 1. Authorization Request: First things first! The client gives their green light for the electronic payment, either by signing a form, chatting over the phone, or using an ultra-secure online form. You wouldn’t want to make a move without that thumbs-up! 2. Payment Information and Setup: The firm takes on the role of friendly data entry—the payment processor needs those nitty-gritty details! Here’s where things get slick. You can set payments to recur or keep it one time. Whatever floats your boat! 3. Finalize and Submit: After all the details line up, it’s game time! The payment gets submitted and flows through the ACH network like a hot knife through butter. Expect transfers to typically take about three to five business days, though a few places have that nifty next-day funding option (things are looking up!). Of course, staying on the nice list—aka legal compliance—is vital. Funds must be funneled into specific accounts depending on the type of payment. But don't sweat it, because there are numerous legal e-billing software solutions out there ready to pull everything together, reducing the likelihood of errors like your cat accidentally knocking over that carefully arranged set of coasters. In this high-tech age, eChecks are proving to be a nifty sidekick in our payment processes.Now we are going to talk about a question that often pops up: Are eChecks safe? You might be surprised to learn that they are indeed as secure as other digital payment options—so put away that worry wart hat!

How Secure Are eChecks?

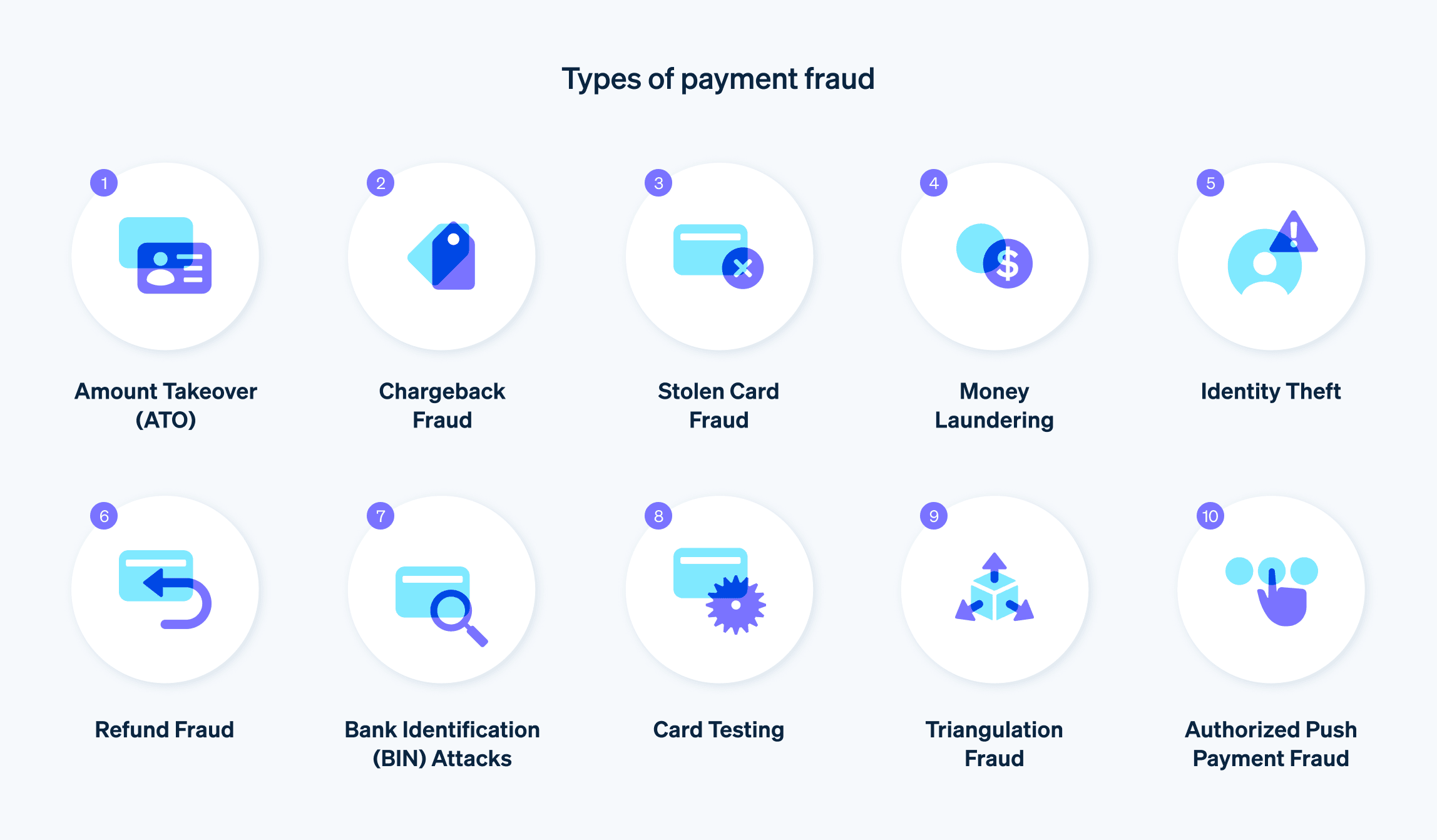

Let’s be real, though. Like any online transactions, eChecks aren’t completely foolproof. A key risk factor comes into play when bad actors sneak in and grab previous invoices or sensitive client information from a data breach. It’s almost like those pesky magicians who make things disappear—except, in this case, it's your data! If someone gets a hold of this info, they could pull off a fraudulent payment without breaking a sweat. Unlike your grandma's homemade pies, there’s no physical proof needed—just the right digits.

So, instead of wondering, “Are eChecks safe?” it’s more essential to ask, “Is my payment solution safe?” A little introspection never hurt anyone!

If adding eChecks to your list of payment options sounds like a good idea, it’s crucial to choose a payment solution that has these basic features:

- Encrypted: Always make sure that sensitive information gets wrapped in proper encryption during the payment process. Think of it like putting your secret recipe in a safe.

- Secure: Opt for payment portals that comply with the latest data security standards. Nobody wants their cash floating around in the cyber desert.

- Legally Compliant: Save yourself from ethical pickle situations by ensuring your eCheck payments meet IOLTA and other jurisdiction-specific requirements. It’s like checking the expiry date on your milk—better safe than sour!

As it stands, eChecks are generally a safer bet than paper checks. When firms utilize secure online payment software for eCheck transactions, it dramatically reduces the chances of identity theft. No opportunities for shady business, and all sensitive info gets encrypted. Plus, clients' accounting and routing numbers get verified—so there's no chance of “oops, wrong account.”

| Feature | Benefit |

|---|---|

| Encryption | Protects sensitive data during transactions |

| Compliance | Avoids legal headaches |

| Verification | Ensures accurate transactions |

So, in short, while eChecks have their risks, they stand tall as a smart payment option—especially with proper safeguards in place. Just like you wouldn't go to a barbecue without checking if the grill has propane, always ensure your eChecks are enforced with caution! Your bottom line will thank you later!

Now we are going to talk about why embracing electronic checks can be a real blessing for law firms. The way we pay for things has changed dramatically, and keeping up can make all the difference. Think of it like getting a smartphone after a lifetime of flip phones—once you make the switch, you wonder how you ever got by without it!

Benefits of Accepting Electronic Checks for Law Firms

Boosts Revenue and Saves Time

When we think about payments, we can't help but remember that one uncashed check from Aunt Edna that we lost track of for six months. Well, eChecks won't find themselves lost in the couch cushions, that's for sure! They come with lower processing fees than those pesky credit cards. The nickel-and-diming on transactions can really pile up, and nobody wants to see their profits evaporate like that last slice of pizza at a party. Plus, eChecks streamline the whole payment process. No more chasing down clients to get those checks delivered or arguing about who owes what! Just imagine the savings on coffee and donuts you used to bribe your team to manually log in all those paper checks. With faster processing times, your firm will have cold, hard cash much sooner—or at least, as soon as it's allowed to leave the bank!Enhanced Security and Compliance

Now let’s not kid ourselves; we watch enough crime dramas to know the perils of paper checks. The risks associated with physical checks make us think about old-school spies and stolen identities—nobody wants that drama in their practice! With eChecks, you lower the chance of fraud because clients won’t need to physically send their sensitive information through the postal maze. Plus, modern eCheck solutions have features that allow clients to log into secure portals—talk about high-tech! It's like getting a bouncer for your money. And oh boy, let’s not overlook the heavenly ease of digital logs making compliance a breeze. Your accounting team will wonder how they ever managed with paper records. Keeping everything in order practically feels like they’re “The Secret Life of Walter Mitty,” but busy filing taxes!Convenient Payment Options for Clients

Let’s face it—waiting on clients to write checks is as thrilling as watching paint dry! With electronic checks, clients can type their banking info in a secure portal and hit “send.” Voilà! Like magic (well, tech magic), their payment is on the way faster than a cat on a hot tin roof. Clients appreciate immediacy in this fast-paced world. According to a recent study, a whopping 60% of consumers desire quicker confirmation of payments. With eChecks, they’ll see their payment status without turning into amateur detectives. And speaking of convenience, setting up recurring payments is like setting a timer for that microwave popcorn—it just makes life easier! They can choose how often to pay, making it a win-win for everyone involved.Ditching Paper for a Better Tomorrow

Walking the paperless path isn't just for environmentally conscious hipsters anymore; it's becoming a necessity. Accepting eChecks means eliminating paper waste, which especially resonates with eco-friendly firms. Every sheet we don’t use is one less tree we chop down. Plus, less physical paperwork means less time searching for information under those ever-growing piles on desks. With digital solutions, you won’t have to sift through reams of invoices; everything is neat and tidy right where you need it. And taking that leap into digital payment isn't just good for your firm’s bottom line; it’s also a “hug-it-out” moment for Mother Earth! Switching to electronic checks is like ordering takeout instead of slaving away in the kitchen—so much easier and so much better for everyone involved! So why not give eChecks a whirl and elevate your firm's operations?Now, we are going to talk about how law firms can effectively implement eCheck payments. This isn't just about accepting a new method; it’s about making payment processes smoother for clients and ensuring compliance. Let's jump right in!

Strategies for Law Firms Utilizing eCheck Payments

Be Open About Your Billing Process

When considering eCheck payments, it’s essential to remember one thing: we all love clarity. Imagine being at a restaurant and not knowing if they take credit cards or not. Awkward, right? So, let’s spare our clients the confusion. Outline every payment option they have right from the get-go. Keep clients in the loop about their options when sending out electronic invoices. For recurring eCheck payments, be transparent about when and how those payments will be deducted. A simple guide on how to pay using eChecks would go a long way. And let’s face it, some clients might think these electronic methods are about as secure as a paper boat in a hurricane. A solid FAQ page addressing their concerns can really ease their minds!

Stick to Trust Accounting Rules

While convenience is the name of the game, remember that improper handling can lead to some serious headaches. Many third-party payment processors aren’t equipped to handle IOLTA or Trust Accounting requirements. If eCheck payments aren’t compliant, those benefits could vanish faster than cake at a birthday party. Using industry-specific software designed to maintain compliance is essential. These platforms often take the cake when it comes to integrating multiple payment methods without fuss. How about collecting eChecks, credit card information, and digital wallets all in one spot? It beats juggling your payments like a circus act!

Keep an Eye on Payment Trends

A central system for payments, including eChecks, will not only save time but provide valuable insights. Ever noticed clients jumping ship from eChecks to another method? It’s like getting dumped and left wondering what went wrong. Dive into those statistics; they tell you every little detail about their payment habits. If clients are struggling, it might be time to streamline the eCheck payment process. With lower processing fees compared to credit cards, getting paid faster leads to better cash flow—and who doesn’t love a little extra liquidity?

So, to sum it up, clear communication, compliance with guidelines, and monitoring trends can elevate how law firms handle payments. Embrace the digital age, and you might just find that clients appreciate the ease of paying with eChecks!

Now, we are going to explore how law firms can easily start accepting eChecks. It’s more straightforward than trying to find a needle in a haystack, let me tell you!

Steps for Law Firms to Accept eCheck Payments

To get rolling with electronic check payments, the first step is signing up for an ACH or eCheck merchant account. You and your team will need to gather a few essential details before you take the plunge:

- The firm’s name and address (not your vacation spot, please!)

- Your federal tax ID number (yes, times like these make tax season a bit more relatable)

- How long the business has been around (like a fine wine, it’s good to know your age)

- Your estimated transaction volume (how much dough are we talking about?)

- Bank information (because that’s where the magic happens)

The whole process is as simple as making toast; it usually takes only a few days to get approved. And if you’re feeling tech-savvy—or just plain lazy—you can even do this through your digital payment provider.

Once you’ve got that shiny new account, companies like LawPay can help set up a payment portal. You know, the kind that makes you feel like you’re handing your clients a golden ticket to hassle-free payments.

Note: The first couple of ACH transfers might feel like waiting for the kettle to boil, moving a tad slowly. However, once you get a few successful transactions under your belt, things will pick up speed, and you’ll be zipping along like a race car!

Accepting eChecks can really streamline your payment process, boosting client satisfaction while keeping you from the hassle of traditional checks. It's all about convenience, right? And who doesn’t love a bit of that?

By incorporating this method, law firms can stay competitive in today's fast-paced financial landscape. As our good buddy Benjamin Franklin once nearly said: “A penny saved is a penny earned,” but with eChecks, it’s more about “a penny collected is a penny safe from the lost and found!” Now, that's something we can all agree on!

Now we are going to talk about the delightful world of processing eChecks with LawPay. It's like finding the last cookie in the jar – unexpectedly satisfying! EChecks are a modern marvel for law firms wanting to simplify their payment processes, making it as easy as pie for clients to pay up.

Simplifying eCheck Payment Processing

With LawPay, accepting eChecks and card payments has never been simpler. We've all had those moments of fumbling with checks, right? But with their system, forget about working your fingers to the bone trying to keep track of things. LawPay's got you covered!

For solo practitioners or petite firms that don’t have a dedicated accounting crew, proper tools for handling digital payments are essential. It's like needing a good blender when you’re trying to make smoothies—no one wants lumpy fruit!

LawPay not only provides easy payment options but also paves the way for smoother billing. Here's what you can expect:

- Flexible Legal Fee Financing: Picture this: clients can pay in installments, while the firm gets its money upfront. It's a win-win! Like that friend who always pays for dinner and says you can Venmo them later.

- Streamlined Time Tracking: Keeping an eye on time and expenses has never been easier—better invoices and less head-scratching on billing days!

- Comprehensive Billing and Invoicing: All your crucial financial bits in one easy platform. Less chaos means more coffee breaks.

Even the folks in highly scrutinized financial sectors like tax law swear by LawPay. Diana Cupps from “Diana the Lawyer” emphasizes how offering various payment options shows a firm’s commitment to client convenience. I mean, who doesn’t like options, right? It’s like being at an all-you-can-eat buffet—so many choices!

| Feature | Description |

|---|---|

| Flexible Legal Fee Financing | Clients can pay in installments while lawyers receive full payment upfront. |

| Streamlined Time Tracking | Easier tracking of hours leads to clearer invoices and better client trust. |

| Comprehensive Billing and Invoicing | All billing data consolidated in one user-friendly platform for simplicity. |

To top it all off, a little nudge from a professional can go a long way. Why not schedule a demo and see how eChecks can transform your practice? They'll have you saying, "Where have you been all my life?"—at least, that’s how we feel about them!

Conclusion

To wrap things up, eChecks are more than just a convenient way to handle payments—they’re a modern solution for busy law firms looking to step into the future (with less paper and more ease). Whether you're already on the eCheck bandwagon or considering a pit stop, it's all about keeping it simple while sprucing up your financial processes. Embracing change doesn’t have to feel like a root canal. In fact, with the right knowledge and a little humor, it can be quite the refreshing experience. So, grab that eCheck and give your firm the boost it deserves!FAQ

- What is an eCheck?

An eCheck is a digital version of a paper check that allows businesses to withdraw funds from a person's checking account using key details such as checking account number, bank routing number, and payment amount. - How do eChecks differ from wire transfers?

eChecks are processed in batches via the ACH system and can sometimes be canceled, while wire transfers are faster, non-reversible, and usually involve larger transactions with fees. - Are eChecks secure?

Yes, eChecks can be secure when processed through proper payment solutions with encryption and compliance with data security standards. However, they are not entirely foolproof. - What are the benefits of eChecks for law firms?

eChecks boost revenue and save time, enhance security and compliance, offer convenient payment options for clients, and reduce paper waste. - How long does it take to process eChecks?

eChecks typically take about three to five business days to process, although some transactions may be completed within 24 to 48 hours. - What steps do law firms need to take to accept eCheck payments?

Law firms should sign up for an ACH or eCheck merchant account and provide necessary details such as business information and bank information. - How can law firms ensure compliance with eCheck payments?

Law firms should utilize industry-specific software designed to handle IOLTA or Trust Accounting requirements and maintain proper compliance. - What should law firms do to communicate their billing process to clients?

Law firms should provide clear information about payment options, including eCheck payments, and address any concerns clients might have through an FAQ page. - What features does LawPay offer for processing eChecks?

LawPay offers flexible legal fee financing, streamlined time tracking, and comprehensive billing and invoicing through one user-friendly platform. - Why are eChecks better than paper checks?

eChecks are generally safer, reduce the risk of fraud, and eliminate the physical handling of checks, making them more efficient for payment processing.